NVIDIA: The "Age of AI" Is Just Beginning

AI datacenter rationalization by Microsoft. Rumors of a slowdown in AI spending. Worries that Chinese developers are undercutting the chip market with new technology…

“What we need is Jensen to come out on Wed to tell everyone that everything’s going to be fine!” bleated one financial analyst in an email this week. And it appears that NVIDIA CEO Jensen Huang did just that on his company’s earnings call last night.

The numbers were encouraging: Quarterly revenue came in at $39.3 billion, above Wall Street’s expectations, with datacenter revenue accounting for $35.6 billion of that, again above the Street’s $34.09 billion estimate. Adjusted EPS was 89 cents, above the 84 cents analysts anticipated.

All of which seems to have quieted some initial concerns that NVIDIA’s report might disappoint, hauling down other stocks with it. Still, investor response to the report was mixed. In midday trading today, shares were selling at $126.55, -4.93 (down 3.76%).

NVIDIA CEO Jensen Huang. Source: NVIDIA

All Systems Go on Blackwell

NVIDIA pins its near-term hopes on its new NVIDIA Blackwell chips, and things looks positive: NVIDIA says production is in full gear and that its quarterly revenue of $11 billion for Blackwell products exceeded company expectations.

“Customers are racing to scale infrastructure to train the next generation of cutting-edge models and unlock the next level of AI capabilities,” said NVIDIA CFO Colette Kress on the earnings call. “With Blackwell, it will be common for these clusters to start with 100,000 GPUs or more. Shipments have already started for multiple infrastructures of this size.”

What Wasn’t So Great

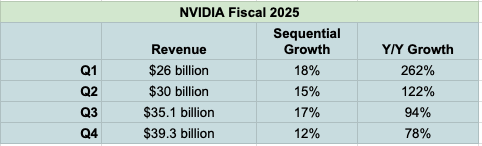

Few financial analysts found fault with last night’s earnings report. But if some emotional investors expected or hoped for another barn-burner, they were out of luck. NVIDIA’s explosive growth over the past couple of years has evened out a bit as initial adoption has solidified, as indicated in the chart below:

Source: Company reports

Another concern is that gross margin is slipping as a result of higher manufacturing costs for Blackwell. “Initially, we are focused on expediting the manufacturing of Blackwell systems to meet strong customer demand as they race to build out Blackwell infrastructure,” said CFO Kress on the earnings call. “When fully ramped, we have many opportunities to improve the cost, and gross margin will improve and return to the mid-70s, late this fiscal year.”

Too Much Dependence on CSPs?

Another concern has been the dependence of NVIDIA on sales to hyperscaler cloud providers such as AWS, Azure, GCP, and Oracle. Together, the cloud service provider group accounts for half of NVIDIA’s datacenter sales. This trend is holding for Blackwell: “Blackwell sales were led by large cloud service providers which represented approximately 50% of our Data Center revenue,” stated CFO Kress in her commentary document. Analysts have had some concerns about NVIDIA’s dependence on this sector, given Microsoft’s recent pullback on datacenter spending.

No worries, said CEO Huang: “Datacenters will increasingly become AI factories, and every company will have either rented or self-operated.” Clearly, he expects the emerging emphasis on inferencing, or the adaptation of trained large language models by enterprises for their own applications, to bolster sales of AI infrastructure, including sales to so-called neocloud GPU-as-a-service providers such as CoreWeave and Lambda.

The Networking Question

Another burr in investors’ hide is the ongoing slowdown in networking revenue this quarter. Posted at $3 billion, networking revenue was down 9% y/y and 3% sequentially, continuing a trend from last quarter. Management maintains the reason for the drop is that NVIDIA is transitioning its networking framework to support larger, Ethernet-based channeling between GPUs and CPUs.

“We are transitioning from small NVLink 8 with Infiniband to large NVLink 72 with Spectrum X,” stated Kress in her commentary. “Networking experienced growth in Ethernet for AI, which includes Spectrum-X end-to-end ethernet platform, and NVLink products related to the ramp of our Grace Blackwell platform.”

DeepSeek Portrayed Positively

Analysts on last night’s call expressed concern over the competitive pressure presented by the introduction of Chinese startup DeepSeek’s new model, which raised questions about the actual requirements for underlying GPU hardware.

The reassurance continued from CEO Huang, who portrayed the DeepSeek models as portents of the coming increase in AI purchasing. “DeepSeek R1 has ignited global enthusiasm,” he said. And a bit later: “We're at the beginning of reasoning AI and inference time scaling. But we're just at the start of the age of AI. Multimodal AI, enterprise AI, sovereign AI and physical AI are right around the corner. We will grow strongly in 2025.”

Futuriom Take: NVIDIA’s latest earnings show positive growth, and CEO Jensen Huang’s reassurances about ongoing success seem solidly based. Expectations of meteoric sales need to be tempered by a realistic outlook that growth in the AI infrastructure market could slow.