What's Next for HPE?

What’s next for Hewlett Packard Enterprise (HPE)? The upcoming few months could be pivotal for the vendor as it navigates several challenges—including the possible failure of its bid to acquire Juniper Networks and its potential moves to compensate for the loss.

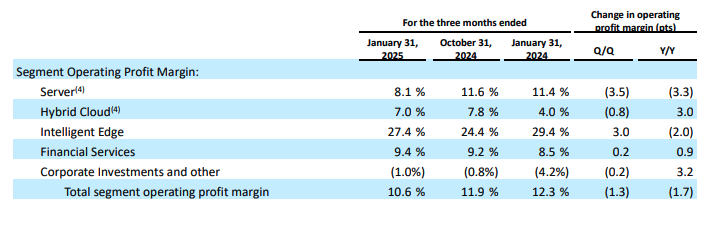

Let’s start with the obvious. In HPE’s most recent quarterly earnings, a handful of issues became apparent: First, the vendor has suffered from reduced profitability due to drooping operating margins, particularly in its Server segment, which saw pricing issues last quarter, along with inventory buildup as the vendor shifts from deploying NVIDIA Hopper chips in its servers to installing Blackwell components.

HPE's segment operating margins. Source: HPE

To offset the slump in operating profit margins, HPE is instituting a layoff of 2,500 people, or 5% of its workforce, with most happening this year and a smaller percentage in 2026. The company also plans to lose another 500 employees through attrition. HPE plans to post $350 million in cost reduction from these measures.

To access the rest of this article, you need a Futuriom CLOUD TRACKER PRO subscription — see below.

Access CLOUD TRACKER PRO

|

CLOUD TRACKER PRO Subscribers — Sign In |