Equinix Aims to Raise $15 Billion for AI Data Centers

Datacenter facilities market leader Equinix (Nasdaq: EQIX) has entered a limited liability joint venture (JV) with GIC, a sovereign wealth fund based in Singapore, and the Canada Pension Plan Investment Board (CPP Investments) to raise at least $15 billion for building out hyperscale datacenters in the U.S.

The joint venture’s goal is to build multiple Equinix xScale datacenters specifically to meet the requirements of cloud providers such as AWS, Google, Meta, and Microsoft, which account for a significant portion of Equinix’s 10,000-plus customer base. These datacenters, typically funded by Equinix JVs, consume more power than the company’s flagship International Business Exchange (IBX) datacenters, which offer colocation facilities for enterprise use.

Indeed, xScale datacenters significantly increase the amount of megawatts of power required per facility. And according to Equinix’s press release, “With the capital raised through the JV, Equinix expects the JV to purchase land to build new state-of-the-art xScale facilities on multiple greater-than-100-megawatt (MW) campuses in the U.S.” (Not long ago, 50 megawatts was considered a high-capacity number.)

JV to Fund xScale Expansion in U.S.

The Equinix JV assigns control of 37.5% of equity interest to CPP and GIC each, with Equinix owning 25% equity interest. The JV will “take on debt” to raise the capital needed to hit its $15 billion target.

The investments should significantly expand the number of xScale datacenters in the U.S. Today, Equinix has a total of 20 xScale datacenters, representing about 8% of the company’s 264 datacenters worldwide. Of the 20 xScale datacenters, just one is in the U.S., in Silicon Valley. Another xScale campus is currently planned for Atlanta. The other operational North American xScale datacenter is in Mexico City.

Equinix has focused heavily on Europe for its xScale projects. Thirteen xScale datacenters are in the EMEA region (with three each in Warsaw Madrid, and Paris, and two each in Milan and Frankfurt). The remaining xScales comprise two in Osaka and one each in Tokyo and Seoul. When finished, there will be about 35 xScale datacenters worldwide.

Is All This Datacenter Horsepower Needed?

The Equinix JV is significant for several reasons, but one stands out: Hyperscaler cloud providers are investing heavily in datacenter facilities, and they’re turning to Equinix for help. While these cloud firms own many of their own datacenters, they lease a substantial amount of resources, and they are anticipated to comprise the world’s largest block of datacenter space within the next decade.

But are these companies betting too heavily on AI in planning their datacenter requirements? Are hyperscalers really counting too much on the trend in what NVIDIA CEO Jensen Huang calls "AI factories"?

No, says one significant source. In a recent interview with Time magazine, Advanced Micro Devices (Nasdaq: AMD) CEO Lisa Su answered the question as to whether there’s a potential AI bubble this way: “Completely wrong…. I think we’ll be surprised, five years from now, how much AI has come into every aspect of our lives, and what we're seeing today is just the very, very tip of the iceberg.”

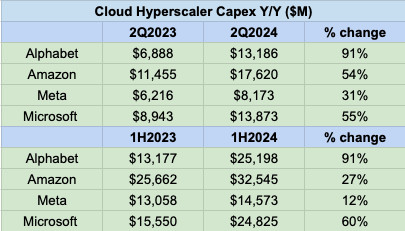

Apparently, hyperscalers agree. They certainly continue to spend heavily on infrastructure. Within the first half of this year, Alphabet, Amazon, Meta, and Microsoft collectively increased their capital expenditures (capex) 44% to $97 billion. And that’s just what they spent on their own infrastructure.

Source: Company reports

For its part, Equinix plans to spend between $2.8 billion and $3.1 billion on its own capex. And with this announcement, it’s betting big on getting much more from the JV project.

Futuriom Take: Equinix’s planned $15B joint venture indicates that the datacenter provider is aligned with those who predict that substantial datacenter resources will be needed to accommodate upcoming AI factories.