Will the Cisco Reorg Work?

Some of you may have been following some of the drama and debate about the future of Cisco, the leading company in the networking market. A month ago we published a detailed analysis of the challenges facing Cisco, a company that has been losing market share in its core networking space and whose stock hasn't gone anywhere during a ten-year technology bull market.

Our "Here's What Cisco Needs to Fix" article, published in June, now has more than 30,000 pageviews (subscription required). Coincidentally or not, on the company's earnings call on August 14th, Cisco announced a massive 7% layoff as well as a corporate restructuring that converges the security and networking businesses. It's clear from the move the Cisco CEO Chuck Robbins and the board have undergone a major shift in mindset, seeing the company's static competitive position as a serious problem.

Why Cisco Is Integrating Divisions

First up, the restructuring of Cisco's divisions and the departure of former networking EVP and GM Jonathan Davidson. Cisco announced that Davidson will be leaving the company and Cisco is combining three of its units under one leader, Jeetu Patel, who will be in charge of the Networking, Security, and Collaboration units.

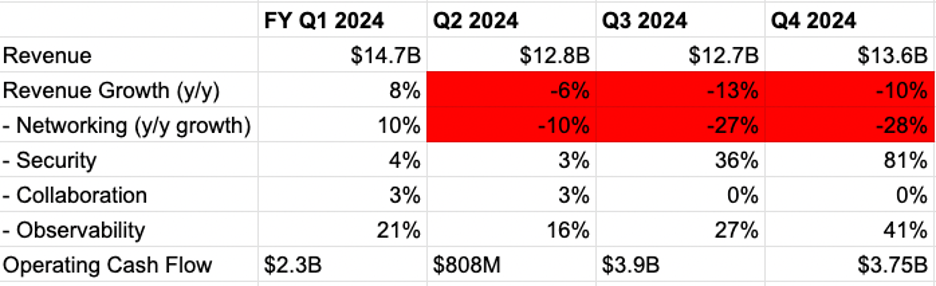

Networking, Cisco's largest division, absolutely has to be fixed. Finally management has realized the urgency. As you can see from the numbers in Cisco's last four quarterly earnings below, the networking division has been a major drag on its numbers. The networking division has been down on a year-over-year (y/y) basis for the past three quarters in a row.

To access the rest of this article, you need a Futuriom CLOUD TRACKER PRO subscription — see below.

Access CLOUD TRACKER PRO

|

CLOUD TRACKER PRO Subscribers — Sign In |