The Futuriom 50: 2024 in Review

As the end of 2024 approaches, it’s time for us at Futuriom to take a long look back at our Futuriom 50 list. This is our chosen selection of 50 of the strongest private companies in key markets for cloud and communications technology. January 2025 will mark our fourth year publishing this report.

As we do every year, we’re examining our 2024 list to see who got the most funding, who’s got the top potential for IPO, who’s likely to stay on this year’s list—and who may not make the cut.

To start our review, following is our 2024 list of 50 companies:

Arrcus, Aryaka Networks, Aviatrix, Aviz Networks, CAST AI, Cato Networks, Chronosphere, ClearBlade, Cockroach Labs, Databricks, Dragos, DriveNets, Enfabrica, Engflow, Exabeam, Fermyon, Fivetran, Fortanix, Graphiant, Hazelcast, Hedgehog, IP Fabric, Itential, Kentik, Kong, Kubecost, Lacework, Netris, Netskope, Orca Security, Prosimo, ProsperOps, Pulumi, Qumulo, Rubrik, Selector, Sonar, Stellar Cyber, Striim, Tecton, Teleport, Tetrate, Tigera, TrueFort, Vantage, Versa Networks, Virtana, Wib, Yugabyte, Zesty.

Who’s Gone Public

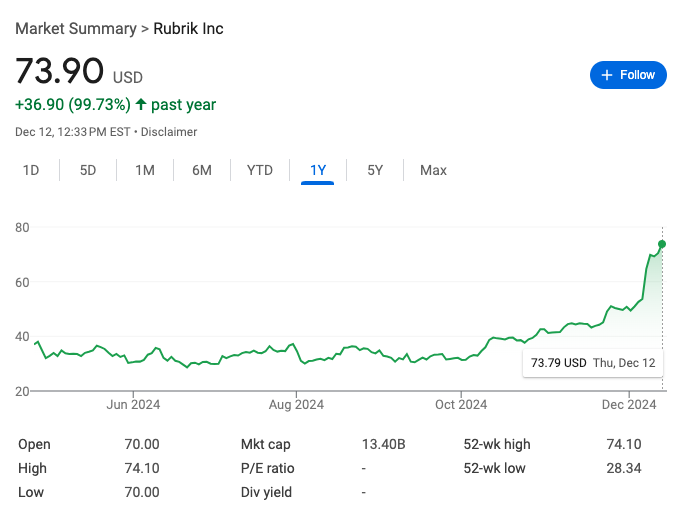

Rubrik, whose Security Cloud software-as-a-service (SaaS) offering encompasses a range of zero-trust features for enterprise, cloud, and SaaS applications, has been on Futuriom’s list since the report was founded in 2021. It finally went public on April 25, 2024, raising $752 million. Since going public, the company’s stock has gone up nearly 100%.

Source: Google

Who’s Been Acquired

So far, three of our Futuriom 50 2024 picks have been acquired and are therefore off consideration for our 2025 list. Following is a summary:

Wib, which makes API security software, was purchased by F5 in February 2024 for a non-material sum. Wib’s products have become part of new API protection solution in F5’s Distributed Cloud Services.

Lacework was sold to Fortinet in August 2024. Despite being one of the industry’s rising cybersecurity stars, Lacework didn’t live up to the expectations that its onetime $8.3 billion valuation raised in the market. Fortinet acquired its cloud-native application protection platform (CNAPP) for a mere $152.3 million in cash.

Kubecost was bought by IBM in September 2024 for an undisclosed sum. The company’s Kubernetes cost optimization software became, along with Apptio and other products, part of IBM’s FinOps Suite. While cloud cost management and FinOps remains a fragmented market, it looks like IBM’s effort to bring products under a unified umbrella is working.

Onramp to IPO?

This year’s list of potential IPO candidates looks a lot like last year’s. In fact, it’s virtually a duplicate. Whether market momentum will be sufficient to get these firms into action next year remains to be seen. Still, as a new U.S. administration takes shape, among other factors, the environment could be favorable. Companies waiting to pull the public trigger include the following:

Cato Networks. With $773 million in funding and a valuation over $3 billion, SASE pioneer Cato Networks acknowledges it’s aiming for IPO. In March 2024, news broke that the company had hired bankers to start the process, which could happen early in 2025.

Cockroach Labs. The open-source, cloud-native, distributed SQL database provider enjoys a dominant market position. Its valuation is about $5 billion, and it’s raised $633 million so far. In 2021, it filed to go public. Since then, though, Cockroach has been crickets about IPO.

Databricks. A market leader in the data lakehouse field it helped define, this company is well positioned as AI spreads and data management issues weigh on enterprises. Still, the company has decided to stall on IPO and instead has raised $10 billion more in Series J funding at a breathtaking valuation of $62 billion.

Fivetran. By moving data automatically among numerous data sources and putting it all in one place for AI workloads for companies such as OpenAI, Fivetran grew its annual recurring revenue to over $300 million in 2024, up from $200 million in 2023. With over $700 million in funding and a multibillion-dollar valuation, could an IPO be imminent? We’ll see.

Netskope. The SASE-based network provider’s CEO and founder Sanjay Beri told the Wall Street Journal in October that the company plans an IPO for the second half of 2025. With over $1 billion in funding and over $500 million in ARR, we think this is one we can count on next year.

Significant Funding in 2024

Enfabrica. In November 2024, this vendor of AI networking silicon that aims to improve the performance and TCO of AI systems scored $115 million in Series C funding, bringing its total to about $240 million since its 2023 debut from stealth. Arm, Cisco Investments, Maverick Silicon, Samsung Catalyst Fund, and VentureTech Alliance were among the investors. This is one we'll be watching.

Kong. This company, billed as an AI-friendly application programming interface (API) management platform, scored $175 million in Series E financing this past November at a valuation of $2 billion. Its total raised is $345 million. Since APIs are key to the development of AI workloads, we think Kong is in a good place at the right time.

Selector AI. The AIOps provider in November raised $33 million in a Series B round, bringing its total funding to $66 million. By using what it calls a network large language model (NLM), the vendor claims to eliminate 90% of the time typically required to solve incidents and outages. This one's on our radar.

Where Are They Now?

Not all of the Futuriom 50 companies had good news to share this year. Exabeam’s merger with LogRhythm was reportedly followed by substantial layoffs. Still, that and a revolving door in the C-suite haven’t prevented the company, still known as Exabeam, from releasing new products and partnerships. We’ll see what the new year brings.

Futuriom Take: The challenges posed by AI, cybersecurity, and ongoing digital transformation are leaving some private technology companies behind, as others pull ahead to IPO or score significant funding. We are taking a close look at who may—or may not—be in a winning position, and our report will be published next month.

Got an idea? Think your firm is a candidate for the Futuriom 50? We are open to all ideas. Companies that would like to submit to our analyst database for Futuriom 50 consideration can do so right here (there is a $199 fee)!