Oracle Earnings Reflect Cloud Strength

Oracle (NYSE: ORCL) delivered mixed results for its fourth fiscal quarter/full year 2024 on June 11, but its share price popped on burgeoning cloud sales and news that Oracle database hardware will be integrated within Google Cloud datacenters.

First, some numbers: For the quarter ended May 31, Oracle posted revenues of $14.3 billion, up 3% year-over-year (y/y). Adjusted net income was $4.6 billion, down from $4.7 billion last year. Adjusted EPS was $1.63, down from $1.67 in 2023.

But Oracle Cloud Infrastructure (OCI), the company’s full-service cloud environment, blew the doors off, with 42% growth y/y. And Oracle reported massive remaining performance obligations (RPO) due to demand for cloud services.

According to Oracle CEO Safra Catz, Oracle signed the largest sales contracts in its history in Q3 and Q4 of its latest fiscal year, driving RPO up 44% to $98 billion. “Throughout fiscal year 2025, I expect continued strong AI demand to push Oracle sales and RPO even higher—and result in double-digit revenue growth this fiscal year,” she said on the earnings call.

As of this writing, Oracle shares were trading at $141.15, up $16.99 (13.64%) over the past five days, and up 36% since the start of the year.

Oracle’s Strategy Is Cloud

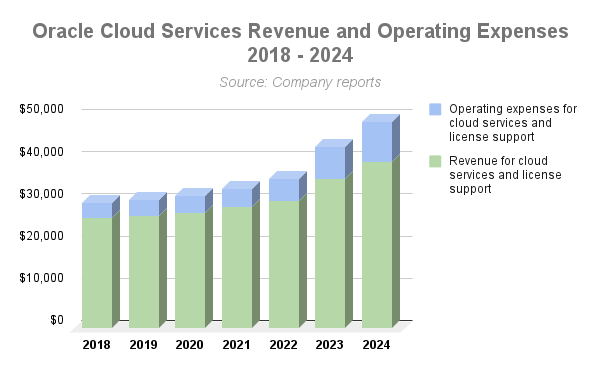

Oracle’s cloud business has thrived since 2018, when the company began reporting "cloud services and license support" as a revenue line item that includes Oracle SaaS and Oracle Cloud Infrastructure. In fiscal 2018, that revenue was $26 billion, or 66% of total revenues. At the close of Oracle’s fiscal 2024, it was $39 billion, or 74% of total sales. Note, however, that as revenues have grown for cloud services, so have operating expenses:

In contrast, Oracle software licenses for Q4 2024 were down 14% to $1.8 billion, reflecting the company’s reliance on cloud growth.

Database Integration with Azure and Google Cloud

Central to Oracle’s earnings announcement was news of its progress in collocating OCI services within Azure and Google Cloud datacenters and integrating OCI with both public clouds. The goal is to allow customers to migrate their cloud-native Oracle database services into applications and services in Azure and Google Cloud.

Last September, Oracle announced that it would install its OCI servers inside Azure datacenters, allowing customers the benefit of integrating their environments. So far, Oracle has installed its hardware in 11 Azure datacenters, with plans to extend OCI to another 12.

When it comes to Google, the partnership is just as impressive, if not more so. Google Cloud is deploying its Cross-Cloud Interconnect product, which links Google Cloud to other cloud providers—in this case, Oracle—with no cross-cloud transfer charges. This setup will be offered initially in 11 Google Cloud regions worldwide, including Australia East (Sydney), Australia South East (Melbourne), Brazil East (São Paulo), Canada South East (Montreal), Germany Central (Frankfurt), India West (Mumbai), Japan East (Tokyo), Singapore, Spain Central (Madrid), UK South (London), and US East (Ashburn). More locations will be added later, the vendors said.

The best deal, though, will come later this year, when Oracle offers Oracle Database@Google Cloud, enabling customers to access OCI directly within Google Cloud. This service will be offered initially in a handful of regions in North America and Europe, with a full dozen planned to go live this fiscal year (June 2024 through May 2025). The goal is to provide customers the fastest, most efficient means of populating AI models and other applications within Google Cloud, including Google’s Gemini foundation models and Vertex AI development platform—which speaks well of Google Cloud’s progress in the market.

Oracle chairman and CTO Larry Ellison said on this week's earnings call that Oracle would “love” to integrate OCI with AWS as well: “We think we should be interconnected to everybody… I think that’s what customers want.” He noted that he’s optimistic that cloud providers will eliminate the fees associated with moving data and allow customers to “mix and match” seamlessly. Whether AWS heeds the message, given its proprietary stance on cloud services, remains to be seen.

Futuriom Take: Oracle’s ongoing success in cloud speaks to the importance of data management in supporting AI workloads. And its multicloud approach could increase customer volume by eliminating the extra costs associated with moving data in and out of various clouds.