Mixed Bag in Cisco Earnings

Cisco Systems (Nasdaq: CSCO) earnings were a mixed bag in the company’s Q1 2025 report this week. Notably, sales of the company’s networking products were down significantly, while security and observability sales grew thanks to the Splunk merger.

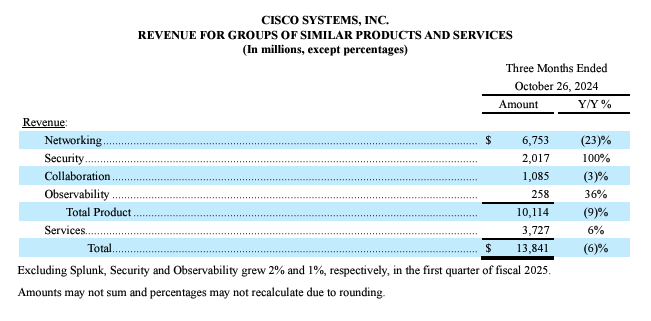

Total quarterly revenue was $13.8 billion, down 6% year-over-year (y/y). Adjusted net income was $3.7 billion, down 19% y/y, and EPS was $0.91, a decrease of 18%. On a brighter note, non-GAAP total gross margin was 69%, compared with 67.1% last year.

Cisco management stressed that despite the drooping sales, the numbers were higher than analyst consensus. And they focused on improved subscription revenue (up 21% to $7.8 billion, or 57% of total revenue); a robust enterprise market (up 33%); strong sales to service providers and cloud hyperscalers (up 28%); and gross margin up 220 basis points y/y, which was over guidance and represented the highest point in over 20 years.

Strength from Splunk

Overall, Cisco’s numbers weren’t bad. And much of that was due to the Splunk merger. For example, Cisco’s Security product sales were up 100%, but excluding Splunk, they were up just 2%. Observability product sales were up 36% y/y, but excluding Splunk, they were up 2%. Total product orders for the quarter were up 20% y/y; without Splunk’s figures, they were down 9%. Clearly, the Splunk acquisition is paying off for Cisco.

At the same time, one of the criticisms of Cisco has been the lack of integration of existing products with those acquired. This latest quarterly report raises questions about the future viability of the vendor’s remaining observability and security products. Will the products that performed poorly be abandoned or fully integrated into the Splunk arsenal? The answer is up in the air.

What’s Up with Networking?

Cisco’s networking sales were down 23%, which management put down to customers digesting the inventory they bought during the same quarter last year. But since networking remains over 67% of Cisco’s total product sales, questions remain.

Source: Cisco

Despite the drop in networking sales, management is optimistic, and in particular about two key networking areas—AI and datacenter switching. “I'd say AI has been a bright spot for us. The bookings that we're seeing inside AI haven't yet turned into revenue, but we certainly are seeing good momentum from that standpoint,” said EVP and CFO Richard Herren on the earnings call.

In datacenter switching, Cisco has high hopes for its Nexus Hyberfabric service, which is meant to simplify the deployment and management of datacenter fabrics based on the vendor’s Series 6000 switches containing Cisco’s Silicon One ASIC.

“Looking at data center switching in particular, we have seen three consecutive quarters of double-digit order growth and an acceleration from Q4 into Q1,” said CEO Chuck Robbins on the earnings call. “This shows our competitive strength in this key market and the power of our Nexus brand and the build-out of private cloud infrastructure by our customers. We expect this momentum to continue as customers are showing significant interest in our 400-gig and 800-gig switches based on Silicon One.”

Looking Ahead

All told, Cisco’s Q1 2025 earnings point to its focus on AI and security. And in AI, the eye is on the hyperscalers first, with enterprise customers coming in a bit later. “In Q1, our webscale customers placed AI infrastructure orders in excess of $300 million,” said CEO Chuck Robbins on the earnings call. “Our AI pipeline continues to be strong. We have earned more design wins and remain confident that we will exceed our target of $1 billion of AI orders this fiscal year from web-scale customers.”

He said enterprise buyers will follow: “Most of the CIOs and technology leaders we talk to say that their organizations are planning full GenAI adoption within the next two years.”

Interestingly, Cisco execs noted that the recent layoffs weren't about cost savings. "We talked about when we did the restructuring that it was not necessarily about driving cost savings," said CFO Herren in response to an analyst's question. "There are some cost savings coming out of it, but that was not the motivating factor. It was more about finding efficiencies across the company and turning around and reinvesting those in the fastest growing parts of our business, namely AI and security, and you see some of the great results coming out of that."

Futuriom Take: Cisco’s “meh” earnings report nevertheless held bright spots for Splunk products and raised hopes for the vendor’s AI-oriented networking wares.