AI Storage Play DDN Scores $300 Million in Funding

DataDirect Networks (DDN), which offers storage arrays tailored for AI environments, has received $300 million from funds managed by Blackstone Tactical Opportunities. The round values DDN at $5 billion.

The move signals the growing role of storage infrastructure in AI processing. Management at DDN says the money will go to improving its systems’ capabilities to streamline data delivery to GPUs in enterprise AI clusters.

DDN Targets Enterprises

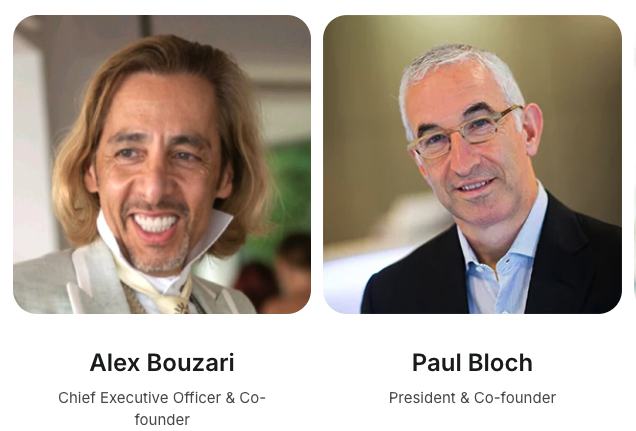

DDN is not a startup. The company was founded by Alex Bouzari (now CEO) and Paul Bloch (president) in 1998, and initially it focused on highly scalable HPC implementations. Recent inroads in this market include providing storage and data management for Elon Musk’s 100,000-BPU xAI Colossus supercomputer, GPU-as-a-service provider Lambda, and clusters deployed by partner NVIDIA.

Bouzari and Bloch say the new money will be used to “accelerate” DDN’s rate of growth among enterprises in a range of verticals. According to the Wall Street Journal, that means expanding its customer base to enterprise customers intent on training AI models and performing inferencing for AI applications more efficiently.

“DDN is laser-focused on solving real AI business challenges, from accelerating LLM deployments to enhancing inferencing, so our customers can unlock their data’s potential and achieve tangible ROI faster than ever,” stated Bloch in a press release.

Source: DDN

How DDN Achieves AI Efficiency

DDN works within AI environments in a number of ways. It deduplicates and compresses data in all formats, reducing the amount of processing and energy required for AI training and inferencing. It supports a parallel file system to provide data to GPUs in parallel instead of sequentially. And it maintains flexibility in delivering all these capabilities, the company says.

In an interview with SiliconANGLE theCUBE at the Supercomputing 2024 (SC24) conference in November, CEO Bouzari said: “It’s all about flexibility. So the technology needs to adapt to absorb and amplify flexibility in the datacenter, in the cloud. That’s what we spent more than a decade perfecting."

DDN Works with NVIDIA

DDN has a longstanding relationship with NVIDIA, and DDN has integrated its EXAScaler parallel file system and Infinia software-defined storage platform with NVIDIA BlueField DPUs.

“This synergy of NVIDIA’s advanced data processing with DDN’s robust storage solutions optimizes AI workflows, enhances operations, improves resource utilization, and supports multi-tenancy in AI environments,” stated NVIDIA’s director of Corporate Ethernet Marketing Tim Lustig in a blog last July. DDN also supports NVIDIA’s GPUDirect Storage, which links GPUs directly to storage arrays, bypassing CPUs and allowing for faster data flows in AI workloads.

The Future for DDN

DDN hasn’t taken new funding since a reportedly bad experience with its first round in 2001. The company, headquartered in Chatsworth, Calif., with about 975 employees, is profitable, claimed $1 billion in bookings in 2024, and didn’t necessarily need the latest tranche. Could it be preparing for IPO?

Interestingly, that doesn’t look to be on the cards yet. The company’s executives have said that there are no current plans for IPO. In his interview with theCUBE at SC24, Bouvari clearly stated his preference for staying private, without the hassles and distractions required of public companies.

DDN faces some competition. In particular, VAST Data has similar claims to manage data for AI storage, thereby improving AI workload efficiency. The infusion of new capital to DDN could strengthen its competitive position in a market that’s demanding that data storage take on the role of data management for AI.

Notably, DDN is trumpeting an upcoming announcement with NVIDIA on February 20, 2025, that could further strengthen its market position.

Futuriom Take: DDN’s recent $300 million funding sets the stage for its advancement into enterprise AI workloads. Its strength in HPC and its strong ties to NVIDIA could boost its position with enterprises considerably.